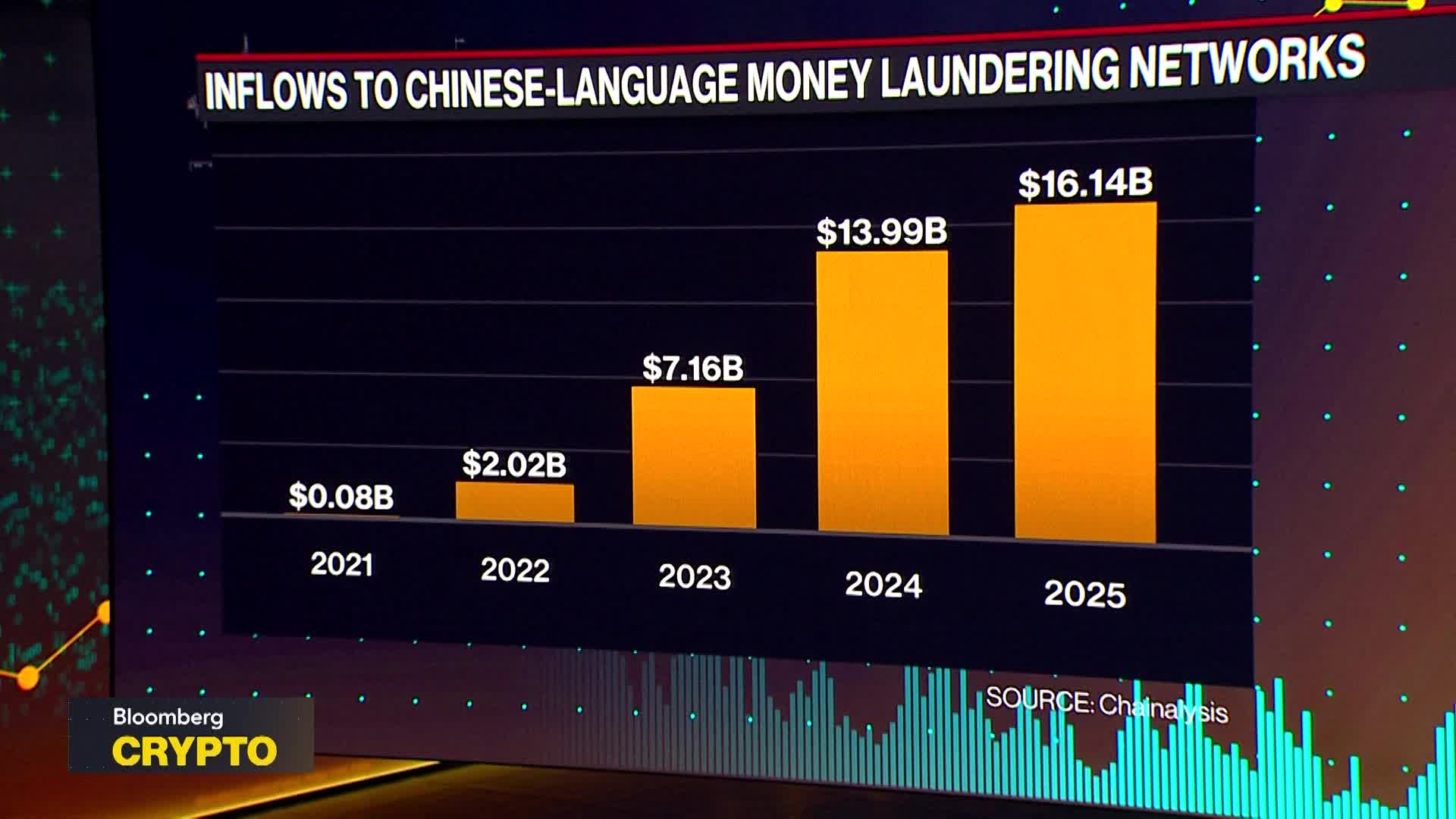

Jonathan, just give us a little bit more context here around the role of Chinese language money laundering networks. How responsible were they for the crypto crime that we saw in 2025? So what we've seen in the history of money laundering, as you just showed the chart, is that we've seen an increase in money laundering networks in crypto as adoption of crypto assets has continued to increase. Now, last year in 2025, we saw $82 billion being laundered through these money laundering networks, using cryptocurrency rails, of which we've seen a massive increase in the amount of Chinese based money laundering networks that have, you know, now got 20% market share. So $16 billion in laundered proceeds last year. And this has been a new development on Telegram and using a whole variety of different methods to actually facilitate money laundering of illicit proceeds from things like romance scams that you heard a lot of on the news. Yeah, you know, I'm not just interested in how they get the money. What I'm interested in is why they think cryptocurrency is is a good way to do this because. Isn't cash still king when it comes to money laundering, when it comes to fraud, when it comes to illicit use of currency, cash just blows everything out of the water, right? That is correct. I mean, when you think about the way in which cash is used or traditional financial real estate or trade based money laundering, those numbers are still much, much higher than what we see inside crypto. The interesting thing, though, is that the specific assets that people are able to identify in crypto are identifiable as money laundering, whereas the estimates on cash and on real estate and on trade based money laundering are just overall percentage estimates of the overall activity. And so the great thing about crypto is that we can actually identify the activity. Now it gets to the challenge of how do we disrupt that activity? How do we how do we make sure that we can have effective ways of getting and infiltrating these networks? Well, not all cryptocurrencies are the same, but my understanding is that one of the reasons why it's not necessarily great for money laundering is because oftentimes we can end well, not we. You at Chainalysis can actually track where that cryptocurrency is going on the blockchain. So so why are people using it and how are they using it if it can be easily tracked by firms like yours? But what we see is that every type of business and whether that is a business that is in the business of organized crime or whether that's a business in terms of global logistics, want to be able to move money instantaneously, programmatically, very cheaply anywhere in the world in an instant. And that is something that both, you know, business demands, individuals demand and organized crime demands. And at the end of the day, organized crime are profit motivated global businesses that are willing to take more risk than anyone else. And so they really are early adopters of any type of technology. And a universal global instant payment system is something that the world needs. It also is also something that organized crime will take advantage of. My question for you is clearly there's a lot that governments and policymakers misunderstand or underestimate when it comes to this illicit use of cryptocurrency, especially when it comes to money laundering. Have they got in touch with you? Are they looking to chain analysis for proposed solutions? Do they give you any feedback? Yeah, we we at Chainalysis provide solutions to both the public sector agencies that regulate cryptocurrency. We provide it to law enforcement agencies that are investigating public safety issues. And we also provide it to intelligence agencies that are responsible for our national security. And so all of these agencies now have chainalysis data, technology and services at their fingertips to gain this intelligence about these types of networks and design disruptive operations to take them down and prevent further harm from happening. And we've been very involved in recovering tens of billions of dollars in criminal proceeds and returning some of those funds to victims of those crimes. Is it enough to for the for the enterprises that you study not to have an incentive to do the crimes? I think that when it comes to this, it's not enough to just say that, you know, law enforcement and national security agencies and regulators are on top of it. We actually need to build disruption into the planning. And really what we have seen change over the past year, particularly when it comes to the Chinese threat, is that this is now moving at a very fast pace. Money is moving programmatically. And we published in our report how quickly and effectively some of these networks are able to leverage the programmability of cryptocurrency. And that means that the government agencies need to have data at their fingertips and need to actually design mechanisms of using AI and automation to go after these types of threats. And we're not quite there yet in terms of adoption from global governments to be able to tackle this type of threat moving forward. So we're not there because the governments haven't bought into it or because we don't own you don't have the technology yet to be able to disrupt it. Like if you could wave a magic wand around the world and have these governments adopt this technology, would that be enough? Yeah, I think it would be enough. I mean, what we've seen is that there have been instances where, you know, criminals are always adopting and it is a cat and mouse game that will continue. But if governments have real time data at their fingertips and are able to target these types of operations using scalable collection mechanisms like Chainalysis, there are avenues of actually disrupting some of these networks, both in the cyber realm but also in the physical costs from the are necessary to inflict massive pain on these organizations. And governments around the world have been sanctioning some of this Chinese money laundering operations, and we need to do just much, much more of that in order to be able to disrupt this type of illicit activity. Jonathan, we talked earlier about how Morgan Stanley has appointed a new head of digital asset strategy. So it clearly the traditional financial firms are very much increasingly getting into crypto. Given what you found in this report, are they ready for this? Are they prepared to keep their clients investment safe? Yeah. I think what we what we have done at Chainalysis over the past year is we've also not just been investigating these networks, but we've also been building solutions to allow for prevention of best prevention of scam activity from impacting the users of financial services funds. And what we have done about this is make sure that we're doing all of that collection under the hood and we're packaging up this intelligence for both the government, but also the banks, the fintechs and the cryptocurrency businesses so that they can be compliant with the AML obligations, that they can prevent fraud in real time and that they can secure all of their on chain infrastructure. And what we're seeing from banks like Morgan Stanley is that they are coming in with a much higher level of expectation of risk management than the industry. And they're building new standards of security fraud prevention and compliance that I think will provide a safe and secure place for everyone to hold and benefit from digital assets.